“I’m anxious all the time”: The Universal Credit claimants set to be plunged into poverty next month

The Joseph Rowntree Foundation predicts an additional 400,000 people on benefits will be hit as families say they are forced to use food banks and avoid heating homes

Lizzy Butterfield with her two sons

Lizzy Butterfield with her two sons

Lizzy Butterfield, 51, was a horticulturist at the National Trust. She is pictured here at the Nunnington Hall garden she looked after

Lizzy Butterfield, 51, was a horticulturist at the National Trust. She is pictured here at the Nunnington Hall garden she looked after

When Lizzy Butterfield lost her job after being furloughed during the first Covid-19 lockdown, she began racking up credit card debts, cashed in her pension, and sold family heirlooms to keep up with mortgage payments.

“It’s impossible to not be in poverty,” Lizzy, from Kirkbymoorside, North Yorkshire, says. “I’m trying to keep us going for another 18 months and then we will have to sell the house.”

Mrs Butterfield found herself relying on the government’s low-income benefit Universal Credit after she lost her job, receiving just over £1,000 a month - a little more than the cost of her mortgage.

She is now worried about how she will afford to live from next month as the cost of energy bills, fuel, and everyday essentials rises – all while benefits are set to face a real-terms cut.

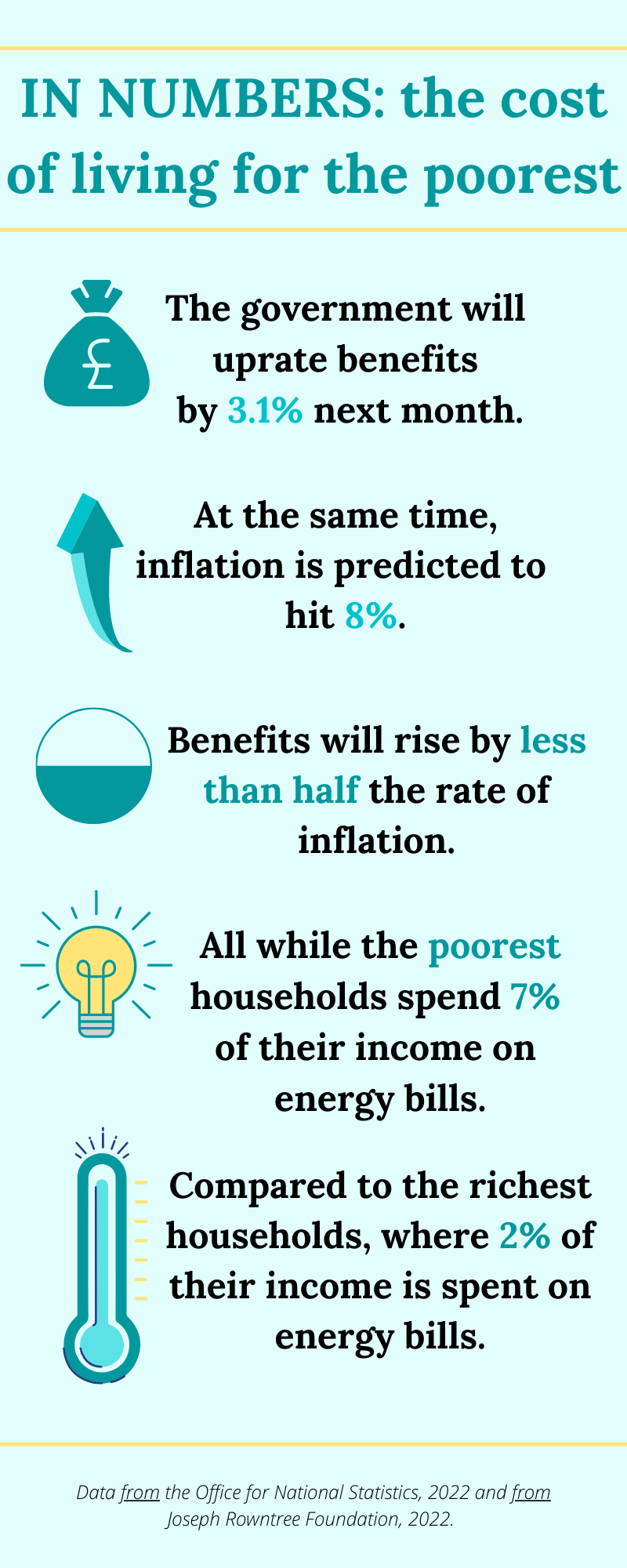

The government will uprate benefits by 3.1% in April – less than half the rate of inflation, which is expected to hit 8%.

Lizzy is not alone in facing this future. According to the Joseph Rowntree Foundation, she is one of an additional 400,000 people claiming benefits who will be plunged into poverty next month.

The Joseph Rowntree Foundation's estimate is based on the rising costs of fuel, food, and household energy bills.

Lucy Bannister, Public Affairs and Campaigns Manager at the Foundation, warns these pressures - alongside a real-terms benefit cut - are about to get even worse for those struggling.

“Families just have nothing left to give,” Ms Bannister says. “At the absolute minimum, the government should be ensuring that benefits do not lose further value just when people need support most.”

Ms Bannister also points out how the government’s removal of the £20-a-week Universal Credit uplift, introduced to help those struggling in lockdown, has been an additional income cut for the poorest people in the country.

The Foundation estimates couples with children who claim Universal Credit are set to experience a £720 annual income loss this year.

They also anticipate the average energy bill could hit up to £2,000-a-year from next month.

When Danielle De Sousa had her benefits capped during the first Covid-19 lockdown, she did not receive the £20-a-week uplift introduced by the government. As a result, she turned to food banks to feed her five children and would go without so she could afford their school uniforms.

Now, Danielle, a single mother to children with disabilities, is no longer benefit capped. But she says next month she will be in the same financial situation she was in 2020.

"More than likely I will go back to using food banks by the end of the year," Danielle, 37, says.

"I am constantly aware of prices going up. I have already told the kids that they will have to cut back on their device usage, and I have decided I will only use the car for essential things like food shopping."

Ms De Sousa, from Sheffield, says she has considered taking up delivery driving jobs, but with her fibromyalgia disability and no family nearby to care for her children, it is simply not possible.

Danielle De Sousa with her youngest child Sebastian, aged 2

Danielle De Sousa with her youngest child Sebastian, aged 2

Danielle, pictured here with her five children, says she thinks "four or five times a day" about how she would "love a job"

Danielle, pictured here with her five children, says she thinks "four or five times a day" about how she would "love a job"

Just before the pandemic hit, Helen Cusworth, 38, lost her job as a carer, where she would work three 12-hour shifts a week. Ever since, she has struggled to find employment.

“It’s getting harder and harder to survive on Universal Credit because the cost of living is going up,” Miss Cusworth says. “I feel anxious all the time.”

“Going forward, it’s going to be a case of going without heating to make sure that I’ve got electric to cook with and keep the fridge-freezer going. That’s the only way I can get around it.”

Helen worked a part-time Christmas job at Meadowhall Shopping Centre in Sheffield last year but still had to fall back on Universal Credit.

While in work, Miss Cusworth was just £10-a-month better off. Now, she attends regular Job Centre sessions and will be asking for a referral to a local food bank.

.

.

.

.

In his Spring Statement last week, Chancellor Rishi Sunak did not introduce any specific measures to support those claiming benefits, despite the warnings from the Joseph Rowntree Foundation.

Mr Sunak announced he would cut fuel duty by 5p per litre and raise the threshold at which people pay national insurance tax by £3,000.

When questioned in a Treasury Committee hearing this week about not uprating benefits in line with inflation, Mr Sunak said: “If someone’s view is that the government can or should make everybody whole for inflation - particularly inflation at these levels caused by global supply factors - then that is something I do not think is doable.”

Inflation has been rising consistently over the last five years, reaching a 30-year high last month. An even sharper rise is forecasted for April, as shown to the left.

But Sheffield South East MP Clive Betts, who is also Chair of the Levelling Up, Housing and Communities Committee disagrees with the Chancellor's view.

Labour's Mr Betts says the failure to uprate benefits in line with inflation is “a number of hits all at once” for the poorest in the country, including his constituent Helen Cusworth.

After hearing of Helen's situation, he says: "That is just outrageous. It is completely unacceptable.

"We're in 2022, we are a rich country. There are people in this country who have more money than they know what to do with, and there are others who literally haven't got enough to feed themselves."

Mr Betts continues below, outlining his Party's view on the rising cost of living.

For more on the cost of living crisis, watch the report above.